Australian Call Centre Rankings Q4 2023

Introduction

There are a lot of misconceptions about call centres in Australia.

From being terrible places to work through to providing horrible customer service plagued by long wait times, poor experiences when speaking to agents, menu options that drive you crazy and so on.

To date, there has been a lack of industry information on the real experiences faced by customers, with the majority of the reports produced by Vendors trying to generate leads and based on customer survey responses (resulting in perceptions more than any solid data) or self-reported data which is unreliable at best.

But there are some great call centres in Australia doing fantastic work, and it’s been a great career for thousands of Australians for decades.

We are already doing a lot to promote the positives of call centre industry, and in August 2023, we commenced publishing the Australian Call Centre Ranking Reports to improve the transparency of the industry performance.

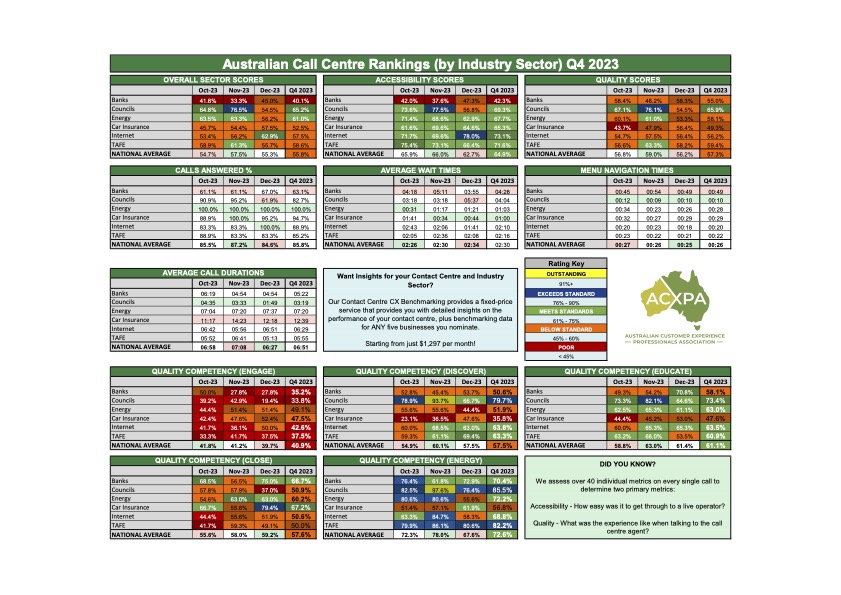

Each month, we conduct a series of mystery shopping calls at random times and days, posing as a real customer, and then we assess the customer experience using 48 different metrics that provide us with three key scores:

- The Accessibility Score captures how easy it was to connect to a live contact centre agent, including wait times, complexity of IVR Menus, hold experience, etc.

- The Quality Score measures the experience received during the interaction with the live contact centre agent using the five core competencies from the Australian Contact Centre Quality Standards: Engage, Discover, Educate, Close and Energy.

- The Overall Score combines the two scores above with proprietary weightings on the competencies that influence the customer experience the most, and it’s this score that is used to determine the overall ranking results.

It’s a warts-and-all report, and sometimes, that data can be quite confronting.

But as an industry, we need to own the good and bad performances.

It’s important to celebrate and recognise the fantastic work our industry delivers daily for millions of Australians – from the small local call centres with a handful of employees to the large call centres with thousands of employees.

And for the call centres not quite delivering to expectations, to ensure they are provided with support, resources and training to help them improve performance for their respective businesses and customers.

Ultimately, there are no excuses for poor call centre performance in 2024.

We are a mature industry with well-defined best practices, tools and resources to help deliver great customer experiences.

If businesses don’t see the value in providing a good customer experience and providing sufficient resources to deliver it, then we as an industry have failed to articulate the benefits of why customer experience really matters at a senior level and equip the call centre managers with the skills they need to manage that internally within their business.

We trust that by providing genuine insights into the performance of the industry and the support, resources and tools to help businesses improve their performance, collectively, we can improve the standards in our industry and deliver improved outcomes for employees working in the industry, the businesses we work in, and for the customers that rely on our expertise.

Key Findings from the Australian Call Centre Industry Rankings Q4 2023 Report

In Q4 2023, for each industry sector, we randomly selected a minimum of six different businesses with the key observations including:

- Energy Retailers were ranked as the best overall sector (61.0%) with Holmesglen TAFE (Vic) at 81.8% and City of Onkaparinga (SA) at 80.9%, the stand-out performers in Q4 2023.

- Banks were the lowest ranked of the industry sectors for Q4 2023 (44.0%), assessed as the lowest industry sector for three consecutive months. All Banks were assessed as below industry standard, ranging from Bendigo Bank (33.3%), the lowest result of all call centres in Australia, to NAB (58.2%).

- The Most Accessible sector (the easiest to connect to a live agent) was the Internet Retailers (73.1%), with the Banks the most difficult to connect to a live agent (42.3%) and the only sector to be rated ‘Poor’ as assessed against our Call Centre Quality Standards.

- Telstra Internet was the most difficult company to access a live agent with an ACCESS score of 13.3%, followed by RACV Insurance with 16.8%.

- TasTAFE (96.9%) and the City of Onkapringa Council in South Australia (96.1%) were the most accessible call centres in Q4 2023, with low wait times and easy (or no) menus.

- Only one industry sector, Energy Providers, answered 100% of the mystery shopping calls within our thresholds (10 minutes for sales calls, 15 minutes for customer service calls).

- Banks failed to answer 39.9% of the calls we made within our 10-minute threshold, with Bendigo Bank the worst offender, failing to answer 66% of the calls we made throughout Q4 within 10 minutes, representing lost sales opportunities and brand/reputation damage.

- The best customer service (Quality) was delivered by the councils (67.1%), with car insurance providers (49.6%) being the poorest. Holmesglen TAFE in Victoria (88.1%) and the City of Casey Council in Victoria (84.2%) were the two stand-out performers for quality customer experiences.

- Budget Direct (30%), AAMI (39.1%) and Dodo Internet (40.2%) were the lowest-ranked contact centres in Australia for Quality.

- Average Wait Times across the industry were 02:31 minutes, with the shortest wait times delivered by the Car Insurance Providers (00:55 minutes), and the longest wait times were the Banks (04:23 minutes).

- The shortest wait times in Australia for Q4 were awarded to Energy Australia and RAC Car Insurance with an average wait time of just 00:03 minutes, followed closely by Budget Direct at 00:04 minutes and iiNet at 00:07 minutes.

- The longest wait times in Australia for Q4 2023 were the City of Casey, Victoria (12:33 minutes), City of Stirling, Western Australia (07:08 minutes) and ANZ Bank (07:37 minutes).

- The time it takes to navigate the menu options (i.e. press 1 for this, press 2 for that) was the shortest in the Councils (00:10 minutes) and the longest in the Banks (00:49 seconds). CBA (01:31 minutes) and AGL (01:23 minutes) had menus that took the longest to navigate.

- In addition to the menu navigation time, customers are also often forced to listen to recorded announcements before they get to speak to a live person. The sector with the shortest forced messages was the Internet Providers (00:10 minutes), with the Car Insurance Providers the longest, forcing customers to listen to an average of 00:57 minutes of recorded messages before talking to a live agent. RACV was the worst in Australia, forcing customers to listen to 02:22 minutes of messaging, followed by AGL (01:59 minutes) and CBA (01:19 minutes).

- Regarding the number of IVR layers (how many layers of press 1 for this, press 2 for that), the Banks had the most, with an average of 3.2 layers, compared to the Councils, with the lowest at 0.6.

- Of the 43 call centres we assessed in Q4 2023, only five call centres had no IVR (11.6%), with Westpac (4.3), CBA (3.7) and Alinta Energy (3.7) having the most number of menu layers.

How to Access All the Report Information:

Our goal is to share data that will help improve the visibility of the call centre industry’s performance, and this report is packed full of free information.

Of course, we provide additional data and insights for our Members, which, in turn, helps us cover the costs of producing the reports and with annual memberships from as low as $35 per employee, we think we provide some great value!

Scroll through the report below or use the links below to jump directly to a specific section.

Leading Call Centres in Australia

Key Results by Industry Sector

Leading Call Centres by Industry Sector

Most Accessible by Industry Sector

Best Quality by Industry Sector

Quality Competencies by Industry Sector

Best Wait Times by Industry Sector

Calls Answered by Industry Sector

Menu Navigation Times by Industry Sector

Australian Call Centre Quality Rankings:

POOR

(<45%)

BELOW STANDARD

(45% to 60%)

MEETS STANDARDS

(61% to 75%)

EXCEEDS STANDARD

(76% to 90%)

OUTSTANDING

(>91%)

Leading Call Centres in Australia Q4 2023

In Q4 2023, we assessed over 40 call centres across six industry sectors to determine the best call centres in Australia.

Each call we make is assessed against 48 individual performance elements aligned to the Australian Call Centre Quality Standards to produce the Call Centre Rankings reports, and based on data for Q4 2023, the leaders for the four key metrics are listed below.

For each metric, we display the top three call centres, as well as the lowest-ranked call centre, to illustrate the gap between the leaders and laggards in each metric.

Congratulations to the call centres below, which have been assessed as the best in Australia for each of the four key metrics.

The Overall Score is determined by how easy it was to connect to a live agent, including wait times, menu navigation ease, etc., and the quality of the live interaction with the contact centre agent (which is weighted higher).

The Accessibility score is determined by how easy it was to connect to a live contact centre agent, including wait time, menu navigation, hold experience, etc.

Scores are calculated for five different competencies, including Search, Design, Ease, Audio and Timing (along with deductions for calls not being answered within thresholds, technical glitches, etc.)

The Quality Score measures the customer service of the interaction with the live contact centre agent that is applicable to any sector, product or service. We assess the quality across five core competencies and 18 individual elements, including Engage, Discover, Educate, Close and Energy.

*More than one business achieved the same result in this sector.

The Average Wait Time is calculated from AFTER the customer has navigated all the menu options and listened to any forced recordings up until the moment the call is answered by a live agent. Additional data for total call duration, average talk time, menu navigation time, etc, is available as part of our Contact Centre CX Benchmarking program.

Key Results by Industry Sector for Q4 2023

Each month, we assess the performance of the Australian Contact Centre industry divided into six industry sectors:

- Banks

- Car Insurance

- Councils

- Energy Providers

- Internet Providers

- TAFEs

Of course, there are more sectors in the industry, with call centres supporting just about every business sector in Australia!

With more support from sponsors and industry bodies, we hope to add additional sectors in the coming future.

For now, the tables below rank the various industry sectors we assessed across four key metrics to illustrate how different sectors are performing.

For each industry sector, we test a minimum of six different businesses.

The Overall Score is determined by how easy it was to connect to a live agent, including wait times, menu navigation ease, etc., and the quality of the live interaction with the contact centre agent (which is weighted higher).

The Accessibility score is determined by how easy it was to connect to a live contact centre agent, including wait time, menu navigation, hold experience, etc.

Scores are calculated for five different competencies, including Search, Design, Ease, Audio and Timing (along with deductions for calls not being answered within thresholds, technical glitches, etc.)

The Quality Score measures the customer service of the interaction with the live contact centre agent that is applicable to any sector, product or service. We assess the quality across five core competencies and 18 individual elements, including Engage, Discover, Educate, Close and Energy.

The Average Wait Time is calculated from AFTER the customer has navigated all the menu options and listened to any forced recordings up until the moment the call is answered by a live agent. Additional data for total call duration, average talk time, menu navigation time, etc, is available as part of our Contact Centre CX Benchmarking program.

Leading Call Centres by Industry Sector (Q4 2023)

For each industry sector, we assess a minimum of six different businesses and display the top three and the lowest score to highlight the disparity between the leaders and laggards.

Additional information about the performance of each industry sector is available in the sector reports – links at the bottom of the page.

Congratulations to the businesses below that are the respective leaders in the industry sector.

Most Accessible by Industry Sector (Q4 2023)

When customers are attempting to contact a business and want to connect to a live person, the Accessibility score is a reflection of how easy that process was.

From how easy it was to find the phone number, how easy the menu navigation was, how long the customer was forced to listen to pre-recorded messages, and, of course, how long they had to wait on hold before they could speak to a live person.

Below we have ranked the top three for each industry sector, along with the lowest score, to illustrate the disparity between the leaders and the laggards.

Congratulations to the businesses below that are the leaders in the respective industry sectors.

Best Quality by Industry Sector (Q4 2023)

Regardless of how easy it was to connect to a live agent, the interaction between the customer and the call centre agent significantly impacts customer satisfaction.

We assess the quality of that interaction across five different quality competencies (refer to the section below), and the overall quality score is the culmination of those results.

Our research has shown that our quality scores directly correlate to better outcomes for the customer and the business and apply to any customer interaction, regardless of the products, service, industry sector, size of the call centre, etc.

Of course, many call centres will (and should) have their own quality standards, compliance standards, quality assessment frameworks, etc and we encourage (and teach) call centres on how to design their own standards that deliver quality aligned to their business objectives.

The Australian Call Centre Quality Standards measure quality across five core competencies and 18 call-handling behaviours.

This enables contact centres to hone in on particular areas that require additional training and coaching to improve the customer experience and, in turn, their business outcomes.

The five core quality competencies are: Engage, Discover, Educate, Close and Energy, with industry sector results for each competency available in the section below.

Best Wait Times by Industry Sector (Q4 2023)

The wait time is often the measure that has the highest correlation to customer frustration.

All of our mystery shopping calls are conducted live by our specially trained assessors, and they wait on hold as part of the assessment process, just like a real customer would.

Of course, we can’t just pay our assessors to wait on hold for hours (it would be a very expensive process), so we draw a line in the sand at which we terminate a call based on reasonable thresholds that an average customer would be prepared to wait.

Mystery Shopping calls are terminated if wait times exceed the following:

- 10:00 minutes (sales-related scenarios where there is an opportunity for new business)

- 15:00 minutes (customer service/general enquiry-related scenarios).

If we have to terminate the call, we use the maximum wait time to calculate the averages, meaning when wait times exceed the threshold, the actual wait times would be higher than the reported average.

Industry Average

Fastest Sector: Car Insurance

Longest Sector: Banks

*More than one business achieved the same result in this sector.

View All TAFEs/Education Data >

Data current as of July 2024

Download the Report

View Additional Information By Industry Sector:

From 2024, we will be publishing quarterly reports for each Industry Sector.

To view the current YTD data and additional information, select the industry sector below.

How many contact centres do you assess in each sector?

We assess a minimum of six different businesses in each sector.

How do you assess the contact centres?

We conduct Mystery Shopping calls posing as a real customer and then assess the call against 48 different performance metrics.

Learn more about how we assess performance >

Can I get the data for each contact centre that was assessed in each sector?

Yes, businesses that purchase the Contact Centre CX Benchmarking receive data on all the contact centre centres assessed in the same sector as you (we guarantee a minimum of five other competitors you can benchmark against).

How many mystery shopping calls do you conduct for each business?

A real customer makes their assessment off the single call they make – they don’t care about averages and minimum sample sizes – their entire judgement will be made from that one call. Harsh, but true!

And that’s what we want to capture in our Call Centre Rankings, what real customers are experiencing.

However, at a minimum, for all our public quarterly reports we will conduct at least nine different calls at different times and days to each business.

Learn more about how we assess performance >

Is there a way to ensure my contact centre is included in the published results?

Yes, if you purchase our Contact Centre CX Benchmarking, your business will be automatically included in the rankings each month.

Is there a way to exclude my contact centre from the published results?

Yes, if you purchase our Contact Centre CX Benchmarking, you have the choice of whether to include the results for your call centre in the rankings published each month.

Regardless, you will always receive insights into your call centre’s results to help you identify the areas you need to work on to improve the results.

I didn’t see my business sector – is there a way to get benchmarking data for my business sector?

Yes! As long as just one business purchases our Contact Centre CX Benchmarking, we will publish results for that sector that will include at least six contact centres for each industry sector.

Is there trend data available?

Yes, view the YTD data >