Executive Summary – Australian Car Insurers Q1 2025

Introduction

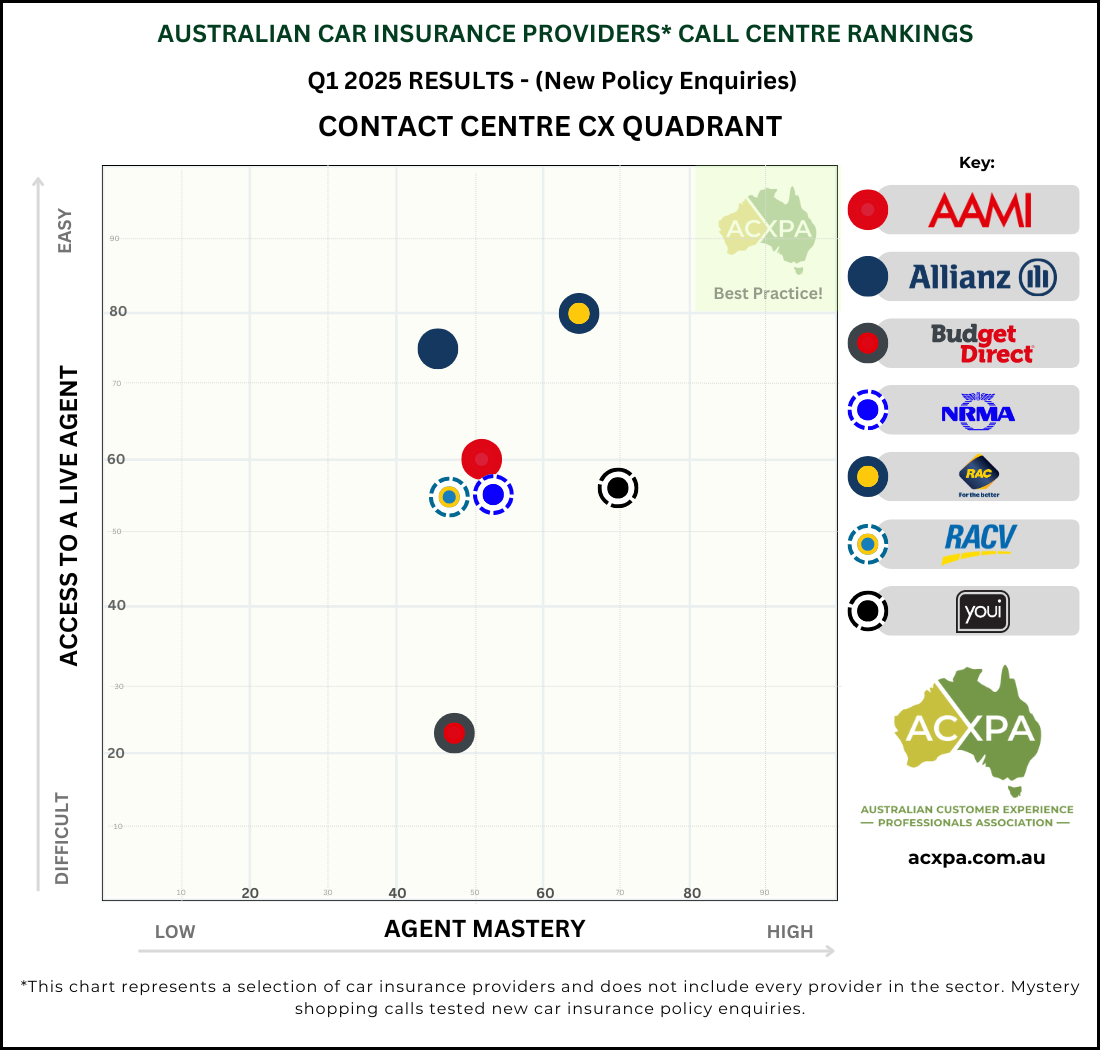

The Q1 2025 results reveal a car insurance sector continuing its steady upward climb in customer experience performance. While long-standing leader YOUI maintained its dominance in Agent Mastery, RAC emerged as the new frontrunner for both Overall CX and Accessibility — a strong sign of competitive pressure driving tangible improvement.

The sector delivered its fourth consecutive quarter of CX gains and ranked second among all industries for Agent Mastery, reflecting a clear focus on the quality of frontline interactions. However, persistent gaps in Accessibility — ranking 6th out of 7 sectors — continue to limit performance, especially in a market where responsiveness can make or break acquisition.

With fierce competition and significant marketing investment, the ability to convert interest into action relies heavily on delivering seamless, human-centred phone experiences. The data suggests some insurers are rising to that challenge, but for others, missed calls and missed opportunities are still too common.

Top Performers

✅ Best Overall CX Performer – RAC (68.5%)

After five consecutive quarters of YOUI leading the sector, RAC has claimed its first win with a CX score of 68.5% – their strongest result since reporting began in Q4 2023.

📈 Top Accessibility Performer – RAC (80.1%)

RAC also topped the Accessibility rankings, rated as the easiest car insurer for customers to reach a live agent.

⭐️ Best Agent Mastery – YOUI (69.8%)

YOUI continues to lead the sector for customer service quality. With a score of 69.8%, they not only topped the car insurance sector but outperformed all other contact centres nationally – setting the benchmark for human-led service in the industry.

💡 Industry Insight:

As a sector, Overall CX performance has improved for four consecutive quarters. Car insurers ranked 2nd across all sectors for Agent Mastery, but persistently low Accessibility scores (6th out of 7 sectors) remain the Achilles’ heel. Given the significant investment in advertising, if customer acquisition is the strategy, then improving Accessibility must be the priority — otherwise, the funnel is leaking from the top.

Biggest CX Challenges

⚖️ A Wide Gap in First Impressions

In a fiercely competitive market, the first interaction can make or break the customer experience — and the variation across insurers is stark. Accessibility scores ranged from just 23.1% (Budget Direct) to 80.1% (RAC). With complex IVRs and long wait times still common, frustrated customers are just a phone call away from choosing a competitor.

📞 Phone Channel Falling Short

Our mystery shopping assessed phone enquiries from consumers looking to switch or take out a new car insurance policy. Despite the competitive environment, the car insurance sector ranked 6th out of 7 for Accessibility — with an average score of just 57.8%. By contrast, Internet Service Providers scored 85.5%, showing that high Accessibility is possible in competitive markets. For insurers serious about improving sales conversion, this should be a top priority.

🧩 Replicating Online Isn’t a Strategy

‘Discover’ – one of the five Agent Mastery competencies we assess – focuses on agents uncovering customer needs through open conversation and active listening. In Q1 2025, car insurers ranked last across all industry sectors for this critical skill. The risk? Agents defaulting to scripted checklists that mimic online forms instead of taking advantage of the very thing that sets human interaction apart: genuine engagement. If the live conversation feels transactional, what exactly are customers gaining by picking up the phone?

🚨 Is YOUI a Victim of Its Own Success?

While YOUI continues to lead the sector for Agent Mastery, Q1 2025 revealed a potential resourcing issue — either from internal challenges or unexpected demand. 22.2% of their calls weren’t answered within 10 minutes, the lowest result among assessed insurers. Only three providers — RAC, NRMA, and Budget Direct — answered 100% of calls within 10 minutes this quarter.

🏆 Key Wins

⏱️ CX Momentum Is Building

The car insurance sector has now delivered four consecutive quarters of CX improvement. While Accessibility remains inconsistent, Agent Mastery continues its upward trend, reaching a sector-high of 53.9% in Q1 2025 — the best result since benchmarking began in Q4 2023.

📣 YOUI Walks the Talk

If you’ve seen a Youi ad, you’ve heard the claim — their call centre team delivers high-quality service. The data backs it up. Not only does YOUI lead the sector, but they’ve also held the top national ranking for Agent Mastery two quarters in a row — setting the bar for frontline excellence.

🏁 Closing the Call – and the Gap

Car insurers topped the leaderboard in the Close competency, scoring 57.7% — the highest across all sectors. This measures how well agents conclude interactions with a final check, express appreciation, and leave a lasting positive impression. While still well short of best practice (100%), it’s a promising strength — because how a conversation ends often defines how it’s remembered.

Recognising Call Centre Excellence for Australian Car Insurers

Congratulations to the top-performing Australian car insurance providers delivering standout customer experiences via their call centre in Q1 2025.

These results are based on independent mystery shopping assessments, using real customer enquiries to evaluate how well contact centres are meeting the expectations of Australian consumers.

Recognition in these rankings goes beyond meeting expectations — it’s a reflection of insurers who are setting the pace in a highly competitive, customer-driven market.

By delivering faster, friendlier, and more effective service, these providers are not only creating better customer experiences but also converting more enquiries into policies and revenue.

Quarterly Trend

Overall CX

Australian Car Insurers

The Overall CX Score is the most important metric in our benchmarking program – a single, weighted score that reflects how easy it is for customers to reach a contact centre and the quality of the experience once connected.

As the defining measure of customer experience, the Overall CX Score blends Accessibility (30%) and Agent Mastery (70%) to reflect both access and impact – with a greater emphasis on the agent’s role in shaping outcomes. Penalties are applied for major breakdowns to ensure a true picture of performance from the customer’s perspective.

Key Metrics Trend – Australian Car Insurers (12-Month View)

The chart below highlights a 12-month trend across three core CX performance metrics for Australian car insurance providers:

- Overall CX – A weighted composite score reflecting the end-to-end customer experience, factoring in accessibility, agent quality, and call handling efficiency.

- Accessibility – The ease of reaching a human agent.

- Agent Mastery – The quality and effectiveness of agent conversations.

Overall CX

This is the headline metric – representing the total customer experience across every stage of the call journey. It’s calculated using a weighted combination of the Accessibility and Agent Mastery scores, providing a holistic view of how well Australian car insurers are supporting prospective customers during key policy and quote interactions.

Accessibility

This measures how easily and quickly potential policyholders can reach a real person. It includes navigating phone menus, clarity of options, queue times, and whether callers successfully speak with a representative. Higher scores reflect smoother, more customer-friendly access experiences – essential in a competitive market where customers can simply call another insurer if service is slow or frustrating.

Agent Mastery

This evaluates the quality and professionalism of frontline service. It includes how well Australian car insurers’ contact centre agents greet, listen, explain policy options, and guide customers through quote or cover enquiries – with clarity, empathy, and confidence. It’s a direct measure of agent capability during high-stakes service moments.

Learn more about the Australian Contact Centre CX Standards that power these assessments.