Tax Deductions for Contact Centre Workers – updated for 2024

Introduction

Yep, it’s tax time again 🤦♂️

But don’t worry, we’ve got your back!

With the cost-of-living crisis making things tougher for everyone, ensuring you claim everything you are entitled to can be a great way to put some extra cash back into your pocket.

To help provide you with some guidance on what you can and can’t claim, we’ve put together this Tax Deductions for Contact Centre Workers in 2024 guide with some help from the Australian Taxation Office (ATO).

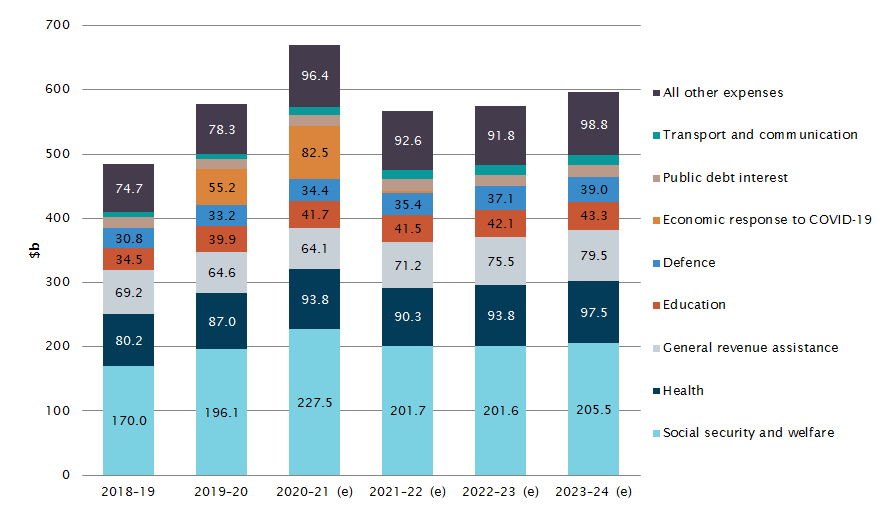

Where does the Government spend our money?

Whilst none of us love paying tax, the reality is that it enables us to live the great lifestyle we have here in Australia and your tax dollars are spread across a range of functions.

But where you might ask?

What Contact Centre Workers can claim as Tax Deductions in 2024

Each year it seems to get tougher, but there are some legitimate ways you can claim to recover some of the tax you’ve paid if the expenses you incurred were related to your employment.

To claim a deduction for work-related expenses:

- you must have spent the money yourself and weren’t reimbursed

- it must directly relate to earning your income

- you must have a record to prove it.*

- You can only claim the work‑related portion of an expense.

You can’t claim a deduction for any part of an expense that does not directly relate to earning your income.

* You can use the myDeductions tool in the ATO app to keep track of your expenses and receipts throughout the year.

Record Keeping

One of the most important things you can do is ensure you keep a good record of your expenses.

Here are a couple of things to remember:

- Having records of your work-related expenses is essential. If you don’t have the proof to support your claim, you can’t claim it.

- A bank or credit card statement (on its own) is not enough evidence to support a work-related expense claim. In most cases, you’ll need a receipt.

- Speaking of receipts, they must show all of the following:

- the cost

- the supplier

- the date of purchase

- the nature of the goods and/or services.

You may need to keep other records depending on the expense type, such as a logbook of your car journeys or records of the hours you work from home.

Have further questions about your work-related expenses?

Speak to a registered tax agent, or check out the ATO website for information on:

Car Expenses

❌ You can’t claim the cost of normal trips between home and work, even if you live a long way from your usual workplace or work outside normal business hours – for example, weekends or early morning shifts.

✅ You can claim the cost of using a car you own when you drive:

- directly between separate jobs on the same day – for example, from your job in a call centre to your second job as a waiter

- to and from an alternate workplace for the same employer on the same day – for example, from your workplace to the company training centre. You can claim parking fees and tolls when you drive your car for work-related purposes – see car expenses conditions above.

✅ You can claim parking fees and tolls when you drive your car for work-related purposes – see car expenses conditions above.

Clothing, Laundry (and shoes!)

With a few exceptions, clothing can’t be deducted as a work-related expense.

❌ You can’t claim the cost to buy, hire, repair or clean conventional clothing you wear for work, even if your employer requires you to wear it and you only wear these items of clothing at work. ‘Conventional clothing’ is everyday clothing worn by people – for example, business attire worn by office workers or plain black pants.

✅ You can claim the cost to buy, hire, repair or clean clothing if it is:

- a compulsory uniform – clothing you are explicitly required to wear by a workplace agreement or policy, which is strictly and consistently enforced, and is sufficiently distinctive to your organisation. For example, an embroidered shirt with your employer’s logo that is compulsory for you to wear at work.

- non-compulsory uniforms that are registered with AusIndustry (check with your employer if you’re not sure).

❌ You can’t claim a deduction if your employer pays for or reimburses you for these expenses.

Self Education & Study Expenses

✅ You can claim self-education, study, seminar and training expenses if your course relates directly to your current job as a call centre operator and it:

- maintains or improves the skills and knowledge you need for your current duties such as the awesome courses specifically designed for contact centres on CX Skills 😉

- results in or is likely to result in an increase in your income from your current employment – for example, studying for a Certificate III in Customer Engagement.

You need to be able to show how the course relates to your employment and have records for the expenses you claim – such as receipts for course fees, text books, stationery and travel expenses.

❌ You can’t claim a deduction if your study is only related in a general way to your current job or is designed to help you get a new job. For example, a call centre operator can’t claim the cost of a course that would enable you to become a mortgage broker.

❌ You can’t claim a deduction if your employer pays for or reimburses you for these expenses

Working from home

✅ If you work from home, you can claim a deduction for expenses you incur that relate to your work. You must:

- use one of the methods set out by us to calculate your deduction

- keep the correct records for the method you use.

❌ You can’t claim:

- coffee, tea, milk and other general household items, even if your employer provides these at work

- items your employer provides – for example, a laptop or a phone

- any items where your employer pays for or reimburses you for the expense.

There are two ways to calculate a work from home deduction:

- the fixed rate method

- the actual cost method.

Using the fixed rate method allows you to claim a rate of 67 cents per hour worked at home.

This amount covers all additional running expenses, such as electricity and gas, phone and internet usage, stationery, and computer consumables.

You can, however, separately claim any depreciating assets, like office furniture or technology. To help with this, try the ATO’s depreciation tool.

If you don’t use the fixed rate method – you’ll need to use the actual cost method, which means apportioning and calculating the actual costs you’ve incurred.

The most important thing is that you have the right records.

Other

✅ You can claim the work-related portion of other expenses that relate to your employment, including:

- logbooks, diaries and pens that you use for work and aren’t provided by your employer

- union and professional association fees

- phone and internet costs, with records showing your work-related use.

❌ You can’t claim:

- parking at your normal place of work, or public transport, taxi or ride-share expenses from home to work, even if you work split shifts or unusual hours

- compulsory pre-employment assessments – for example, a hearing assessment you need to pass as a condition of employment • costs associated with getting a new job, like paying a professional to write your job application

- childcare

- food, drinks or snacks you consume during your normal shift

- grooming expenses, such as hairdressing, skin care products or cosmetics.

❌ You can’t claim a deduction if the cost was met or reimbursed by your employer.

Summary

With the cost of living continuing to rise in 2024 there has never been a more important time to make sure you maximise your tax return and get every cent you can back in your pocket!

Whilst these tips act as a general guide, it always pays to engage a registered tax professional for the best advice.

-

7 Hilarious signs you really work in a call centre

If you work in a job that is on the phones all day, these signs you really work in a call centre will be immediately identifiable!

-

10 signs you’ve been working in a call centre too long

We seriously love the call centre industry but there are some tell-tale signs that maybe you've been working in a call centre too long.

Upcoming ACXPA Member Bites Sessions

Short, sharp interviews and presentations on specific topics to fast-track your knowledge!

The ACXPA Member Bites are only available to ACXPA Members!

ACXPA Members can watch all the ACXPA Member Bites at any time in their Video Library. Discover which membership is right for you >

IVR Best Practice

Over 90% of contact centres are using an IVR (Press 1 for this, press 2 for that), and we've encountered many contact centres with over four layers of options for customers to select from. In this session, Nadine will be sharing some best practice tips on IVR design for 2024.

Presented by Nadine Power, Client Success Manager, VERSA Connects (and ACXPA National Advisory Board Member)

More sessions announced soon!

(If you're interested in speaking at one of our events, click here to learn more >)