As well as the Call Centre Ranking results below, ACXPA Members also have access to a range of additional insights, including all the monthly reports, trend data, additional performance metrics, a downloadable spreadsheet and lots more!

Banks September 2023 Mystery Shopping Results

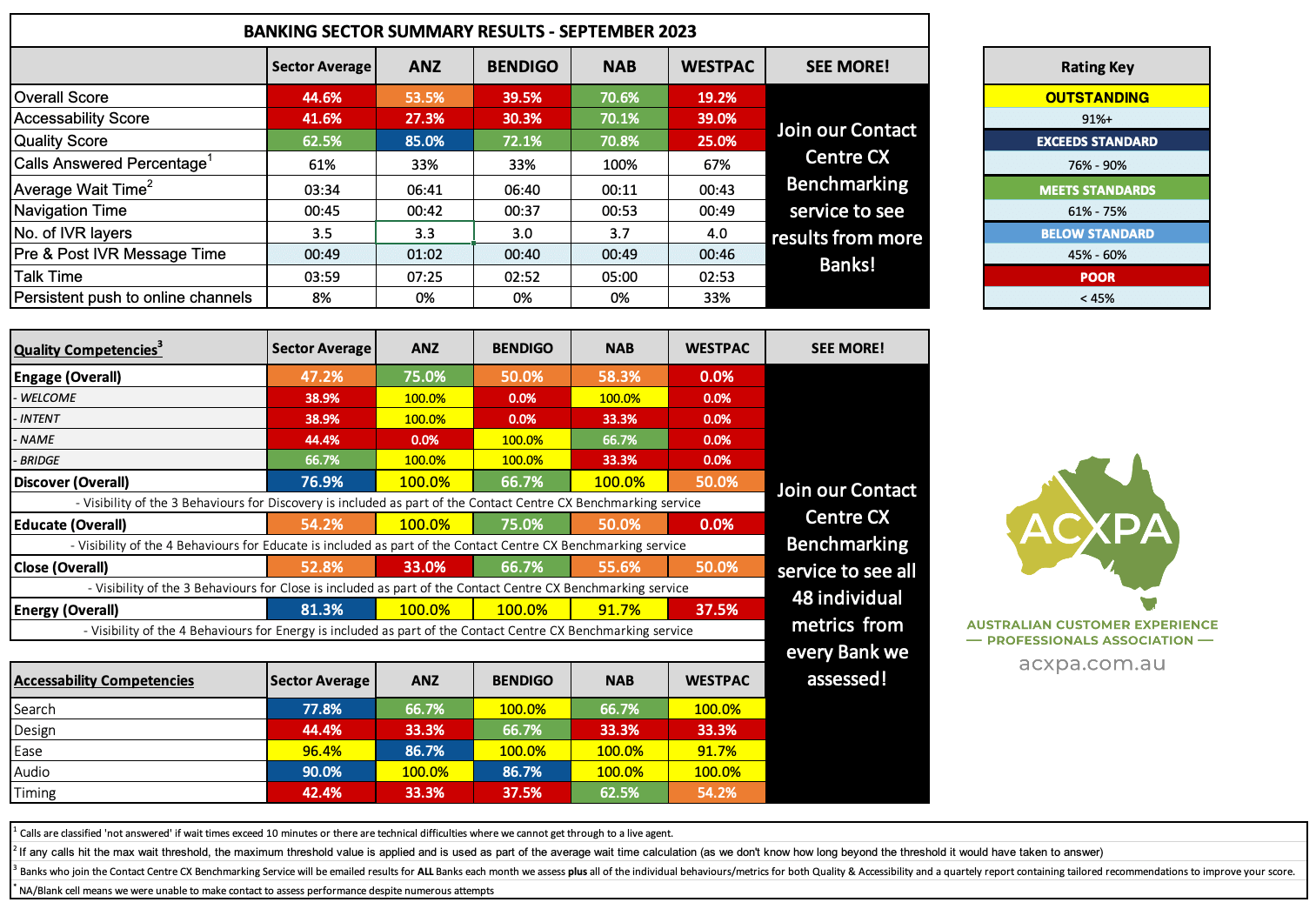

In our second monthly report for the Banking Sector, we saw an improvement of 17.9% for the entire sector from 26.7% in August 2023 to 44.6% in September 2023. Whilst it’s a good improvement, overall, the Banking Sector is still rated as ‘Poor’ primarily driven by extended wait times for customers trying to make contact with a live agent.

The Mystery Shopping scenario used in September 2023 was based on a potential new customer for transaction accounts, high-interest savings accounts and credit cards, all new revenue-generating opportunities for the bank.

Key findings:

- 39% of all Mystery Shopping calls were not answered within 10 minutes (the point at which we disconnect) with only two banks, CBA and NAB, answering 100% of the calls we made.

- ANZ, Bendigo Bank and ING only answered 33% of the calls we made within 10 minutes which, given that the calls were potential new revenue for the bank, is a lost opportunity and a poor first impression for any customer!

- The experience for customers was highly variable – Bendigo Bank for example answered one call in 2 seconds, and at other times were advising of delays in excess of one hour suggesting challenges with their resourcing model.

- Across the majority of banks assessed, customers were subjected to lengthy IVR menus adding 48 seconds to every call with CBA (85 seconds) and NAB (53 seconds) the worst offenders. Bendigo Bank was the leader at 37 seconds.

- Wait times averaged 4:02 minutes across all the banks, a slight decrease from last month, with NAB leading the way with a 11 seconds wait time on average with ING (06:42 minutes), ANZ (06:41 minutes) and BENDIGO (06:40 minutes) having the longest wait times respectively.

- Given the challenges with accessing a live agent, it’s not suprising that the Accessibility score for the Banking sector was rated as ‘Poor’ at 41.6%. ANZ was rated the lowest (27.3%) and NAB the highest (70.8%).

- Overall across the Banking sector, the quality of customer interactions was rated as ‘Meets Standards’ at 62.5% with ANZ ranked the highest (85.0%) and Westpac the lowest (25.0%) suggesting that when customers are actually able to get through to someone, some banks are providing a reasonable level of customer service (although there is plenty of room for improvement!).

- Of the five competencies we assess quality on, the banks were rated ‘Below Standard’ in three of the five categories (Engage, Educate & Close), with ‘energy’ their best result at 81.3%.

- Customers were subjected to lengthy navigation menus with up to four layers of options (Westpac & CBA) with Bendigo Bank the leader with three layers on average.

- Whilst waiting to connect to a live agent, Westpac was the only bank we assessed that prompted customers to move to a digital channel.

Banks September 2023 Key Results

The summary data for the September 2023 Australian Bank’s call centre performance is below.

Overall Ranking

Average Score

Banks Average

#1 Ranked Call Centre

NAB

Lowest Ranked Call Centre

WESTPAC

Quality Score

Average Score

Banks Average

Highest Score

ANZ

Lowest Score

WESTPAC

Quality Summary for September 2023

The Quality of customer interactions for the Banking Sector improved from 44.7% in August 2023 to 62.5% (Met Standards).

- The lead performer for quality was ANZ (85.0%) which is rated as ‘Outstanding’. Unfortunately, ANZ was also rated the worst for Accessibility (27.3%) meaning that it was extremely difficult for customers to get through to a live agent, but when they did, the customer service was the best of all the banks we assessed in September 2023.

- As we struggled to get through to a lot of banks within the 10-minute wait time threshold, the sample size of calls when we actually got to speak to a live agent was low – meaning the average scores were highly influenced by one or two live interactions (which, again, reflects how customers will make a judgement on their singular experience).

- The lead performers in each of the Quality competencies aligned to the Australian Contact Centre Quality Standards are as follows:

-

- ‘Engage’ top performer was ANZ & NAB (75.0%)

- ‘Discover’ top performer was ANZ, ING and NAB (100%)

- ‘Educate’ top performer was ANZ (100%)

- ‘Close’ top performer was Bendigo (66.7%)

- ‘Energy’ top performer was ANZ, Bendigo & ING (100%)

Accessibility Score

Average Score

Banks Average

Highest Score

NAB

Lowest Score

ANZ

Accessibility Summary September 2023

- 39% of all Mystery Shopping calls were not answered within 10 minutes and only two banks answered 100% of all the calls we made (CBA and NAB) with three banks (ANZ, Bendigo and ING) not answering 66% of the calls we made to them within 10 minutes (the point at which we disconnect).

- Across all our accessibility metrics, NAB was rated the highest (70.1%) with ANZ (27.3%) and Westpac (25.0%) all delivering frustrating experiences for customers trying to access a live agent.

- Average wait times across the banks was 04:02 with NAB the shortest wait times (11 seconds) through to ING with an average wait time of 06:42 minutes followed closely by ANZ (06:41 minutes) and Bendigo Bank (06:40 minutes).

- Westpac was the only bank that encouraged customers to move to their online channels on a third of the calls we assessed.

- IVR Navigation can be quite painful for customers with the Commonwealth Bank and Westpac both having four layers of IVR options adding up to an average of 51 seconds to every call.

- Talk times (the time talking to a customer service agent) varied between the banks with Bendigo Bank the shortest (02:52 minutes) through to CBA (07:25 minutes).

Average Wait Time

Average Wait Time

Banks Average

Shortest Wait Time

NAB

Longest Wait Time*

ING

Average Wait Time Summary September 2023

- On average, across the banking sector, customers were waiting in a queue for 04:02 minutes, down from 04:42 in August 2023.

- NAB again had the shortest wait times of all the Banks (11 seconds) (they led in August 2023 as well with a 22 second average wait time)

- ANZ, Bendigo Bank and ING all had average wait times in excess of 6 minutes however as we disconnect the call at 10 minutes, the actual wait times would be much higher (66% of the calls we made to those banks hit the threshold) with Bendigo Bank advising they had wait times in excess of one hour as part of the hold messaging.

- There was however a wide variance in the wait time experiences for customers. Bendigo Bank, for example, answered one call in 2 seconds and two other calls went over the 10-minute threshold with delays in excess of an hour. ANZ and Bendigo Bank had a similar story, demonstrating the wide variance in the customer experience and how it can be the ‘luck of the draw’ for customers as to whether they happened to call at a busy period or not. It also reflects the inability of the banks to accurately schedule their resources to meet the forecasted demand (this is typically due to a lack of resources or WFM technology/skills).

*We disconnect calls that go beyond a 10-minute wait time, so the actual wait times may be longer.

Exclusive Members-only Insights

What type of scenarios do we use to conduct the Mystery Shopping calls?

We use enquiries that are general in nature that don’t require us to disclose personal information.

How does the scoring work?

Over the past 30 years we’ve developed standards based on consumer preferences and the metrics that matter – the ones that can influence the customer experience. You can learn more about the framework we use here >

How many calls are assessed?

For the public monthly report, we include at least three calls per Bank – as more Banks sign up for the service, more calls will be included.

When you sign your Bank up for the Contact Centre CX Benchmarking service, you will receive a minimum of six calls assessed for every Bank included. If you’d rather have a larger sample size, please refer to our customised Benchmarking service >

How can we improve our score?

Our Mystery Shopping program has been designed to provide Banks with the insights they need to improve performance! You’ll receive detailed information on your performance against over 48 individual elements so you know exactly where to focus, and we also include a quarterly report that provides you with personalised key recommendations on areas to focus on.

We also offer a range of training courses that can help teach your frontline employees the skills they need to deliver great customer service (Customer Service Phone ‘Essentials‘ & ‘Professional‘), as well as training courses for your Team Leaders/Managers so they know how to coach effectively using the Quality Framework to improve your performance (and scores!).

How do I get my contact centre included?

We have a fixed-price service starting from $1,297 per month that will provide you with information on your Bank, as well as a benchmark of your performance against a minimum of five other Banks that you can nominate. Learn more >

How do I order the service?

We have an online ordering form that makes it easy to order the service, nominate the Banks you’d like to benchmark against, who you’d like the reports to be sent to etc. View the online order form >

How do I access the data for Banks?

ACXPA Business Members get full access to the summary monthly data for Banks (and other sectors) along with a host of other benefits which contains the data for four random Banks each month.

An ACXPA Business Membership starts from just $497 per year and includes five individual memberships you can allocate to key employees who could benefit from gaining access to leading industry insights for contact centres, customer experience (CX), digital service, and in-person customer service.

If you sign your Bank up to the Contact Centre CX Benchmarking Service, you will gain access to ALL data from ALL Banks.

Is there someone I can speak to to learn more?

Absolutely! If you’d like to speak to someone further about the Benchmarking Service, please get in touch with our General Manager of Quality Insights, Simon Blair – 0407 002 113 or [email protected]

What type of scenarios do we use to conduct the Mystery Shopping calls?

Questions about credit cards, home loans, savings accounts, term deposits etc – most of our scenarios are about new business opportunities for the Banks that don’t require us to disclose personal information.

Do the Banks really care about the service they provide?

We’d really like to say yes as it’s a highly competitive marketplace and research consistently shows that when customers aren’t happy, it’s bad for business.

But sometimes whether it’s through a lack of resources or skills, the customer experience that is delivered is well below expectations.

When banks focus on delivering a better customer experience, not only is it good for you, but it also helps make them more profitable so everyone wins.

How do I get my Bank included?

We encourage you to contact your Bank and ask them to ensure they are included. Just send them a link to this page!

Why does ACXPA publish results each month?

Our mission is to improve the level of customer experience in Australia so by publishing the results monthly, we’ll continue to ensure that Banks are accountable for the level of customer service they are providing.

What type of services does ACXPA offer?

In addition to the Mystery Shopping CX Benchmarking, we offer a range of services and resources for people working in contact centres, customer experience (CX), digital service and in-person customer service/retail. You can learn more about us here >

How to gain exclusive insights for your Bank

If you’d like to gain insights specifically for your Bank’s contact centre performance, and benchmark your results against other banks, we’ve got a new, cost-effective, fixed-price benchmarking service that makes it easy!

Starting from just $1,297 per month, by signing up for our Contact Centre CX Benchmarking Service, you’ll receive the following:

- Six Mystery Shopping calls into your call centre each month at random times and days where you’ll receive the full assessment against 48 metrics, our quality assessor’s notes, the employee’s name (where provided) and the full call recordings.

- Six Mystery Shopping calls each into five other Banks (a total of 30 calls) that YOU nominate so you can benchmark your performance against other Banks that matter the most to you.

- Aggregate data from all the other Banks we assess providing you with Banking sector-wide results to further compare your results to.

- A monthly email with data to track your performance along with the call recordings.

- A quarterly report containing insights and trends that are easy to understand, along with actionable recommendations to help improve your performance.

- An optional Quarterly Insights workshop for your team (conducted live via Zoom) that can provide additional insights, coaching and guidance.

- Access to training to help you improve results.

Next Members Symposium Livestream: Tuesday, 21st May, 2024, 13:30 AEST

The Members Symposium sessions are only available to ACXPA Members!

ACXPA Members can watch the symposium live, and, can watch any of the sessions at any time in their Video Library.

Preview of upcoming Symposium Sessions:

IVR Best Practice

Over 90% of contact centres are using an IVR (Press 1 for this, press 2 for that), and we've encountered many contact centres with over four layers of options for customers to select from. In this session, Nadine will be sharing some best practice tips on IVR design for 2024.

Presented by Nadine Power, Chief Product Officer, Datagamz (and ACXPA National Advisory Board Member)

Tips to Boost Engagement on Calls

Of the five quality competencies we assess as part of the Australian Call Centre Rankings, the 'ENGAGE' competency from the Australian Contact Centre Quality Standards has consistently been at the bottom of the rankings throughout 2023 and into 2024.

In this session, Simon will provide some tips that can be shared with agents on how to increase engagement with customers at the start of calls.

Presented by Simon Blair, General Manager Quality Insights, ACXPA

More sessions announced soon!

(If you're interested in speaking at one of our events, click here to learn more >)